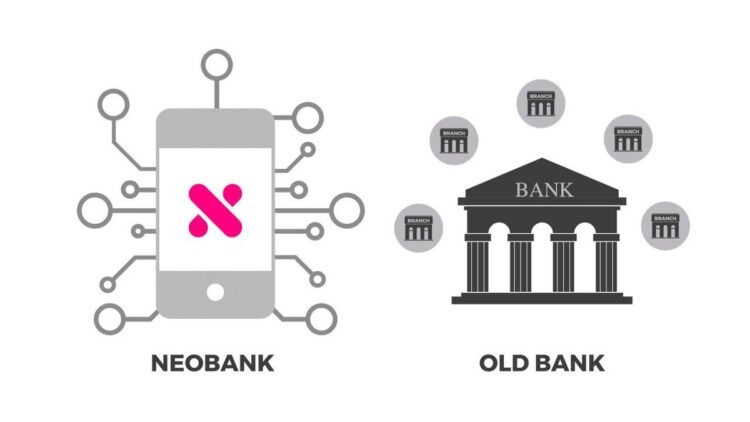

As digital attains new high, the idea of banking without a physical presence is gaining customers. Internationally, many big banks have started reducing their physical presence. In India too, many banks have modernized themselves with new-age Neo Banks for a unified customer gaining and product offering.

What is Neo Bank?

Neo Banks are 100% digital in nature. They operate completely online without any physical presence. They offer multiple monetary services for an account. Neo Banks partner with the traditional banks and help them acquire customers in the most unified manner.

How does it work?

Being completely digital, the focus is on key areas depending on their corporations with the banks. The majority of them operate in the five segments.

1) Battered customer segment. Neo banks are skilled in easier customer gaining- customers include tech knowledge millennials, SME and low-ticket salary class, which are not the focus areas of heritage banks

2) Lesser costs, due to lack of physical presence and low capital investment

3) Lesser charges and easier customer gaining

4) ‘Born in tech platform’

5) Dedicated banking solutions –with a whole collection of services including payments, receivables, budget, and spend management.

Internationally, the Neo Banks also operate in, credit cards, forex cards and payments, cash flow management and business banking services, expense management, and loan products.

Neo Banks in India

There are many Neo Banks working in India currently and a few more are in the pipeline. Neo Banks in India have also managed to raise hefty funds. In 2019 alone, Indian Neo Banks raised more than USD 90 mn. Neo banks in India are taking a distinguished and less hostile approach in the position they are offering.

Challenges for Neo Banks in India

While Neo Banks are scaling up their presence very antagonistically, there are delays. The major interval is the tacky customers and lack of guidelines. Reserve Bank of India (RBI) has not permitted a 100% digital bank model in India. This will keep the terminus of Neo Banks blurred. They don’t know whether they will be allowed to lend on their books and raise deposits on their credibility as an individual bank. Till then, they will have no other substitute but to continue associating with the traditional banks.

On the consumer side, Neo Banks will attract many millennials, the encounter will remain with the rural market where there is a vast population. Despite offering ease of access and better service, the majority of the rural population will prefer to visit physical banks and look for assistance from personal relationship managers. But with many more banks in the pipeline in this sector and supervisor singenuity in this space may change the picture over the next 2-3 years. Another business encounter that they can face is to find a stream of income. Low UPI transfer charges, interchange fees, and payments may not be the main source of income.

Neo Banks Internationally

Internationally the Neo Bank segment is aera old. The international Neo-bank marketplace was worth USD 18.6 billion in 2018 and is expected to fast-track at a combined annual growth rate of around 50% between 2021 and 2026, generating approx. $394.6 billion by 2026. The Neo Banking marketplace is large in the UK, with 15 authorize grants since 2005. 9% of British adults have a Neo Bank account. Neobanks have nearly increased their customer base in the past year, from 20 million customers in 2019 to almost 50 million in 2021.

Neo Banks internationally are well-known for faster customer gaining and consumer appeal vs heritage banks. They offer wider products as internationally Neo Banks are allowed to take deposits and lend on their own books. However, Success and competitive agility remain pressure points for Neo Banks globally.

Read More: Vaibhav Kakkar Journey from Content Writer to An Entrepreneur